Rising insurance premiums and deductibles have been top of mind for many Strata Corporations and condo owners across BC. According to the B.C. Financial Services Authority (BCFSA), the recent hikes in insurance premiums are due to lack of capacity (ex. reduced supply, fewer insurers, and increased demand – more properties), severe weather, increasing property values, and the rising costs of new construction. Another element that is driving the skyrocketing insurance premiums is risk factor. Condos are higher risk due to age, proximity, catastrophic exposure, claims history, and construction type. In Vancouver, water damage continues to be a major concern and the most frequent loss for condo buildings. So what does this mean for you? Strata Corporation insurance policy deductibles are increasing and shifting responsibility on homeowners, their individual condos, and their insurance policies. Here are 3 things you can do to help:

- Review Your Policy

It is beneficial to review your insurance policy once a year. Understanding your insurance policy can help you decide whether your insurance still meets your needs. When you initially chose your insurance package, you probably took your condo’s current state into account. Since then, you may have undergone renovations or upgrades that increased your condo unit’s value. Ensure sufficient coverage is in place for any betterments and improvements made by you or the previous owner. Make sure coverage limits match the deductible amounts of the Strata Corporation’s insurance policy. A copy should be included in your AGM Notice, or you can obtain a copy from your Strata’s management company.

- Inquire about Discounts

There are many ways to lower insurance premiums as a condo homeowner. Using a single insurance provider for all your insurance needs can be beneficial. Depending on your insurance provider, you may qualify for discounts that you were not aware of. Insurers often provide discounts for having no claims history (often 5 years claim free), bundling your insurance policies with other properties, products, or services, increasing security (having a monitored alarm system), being a non-smoker, senior’s eligibility, and having a good credit score. Another option to consider is increasing your deductible amount. If the deductible on your premium is $100 or $500, enquire about the cost savings of increasing your deductible to $1,000, and consider “self-insurance”.

- Take Preventative Measures

Maintaining your condo is important for lowering insurance premiums. This not only includes building and unit upgrades, but also individual unit maintenance. Plumbing and electrical replacements, appliance upgrades, and frequent hot water tank upkeep are proactive measures that can help prevent floods, fires, and other major emergency damage. One of the best ways to reduce future insurance premium increases is to have no claims history and show insurers that your unit is well maintained.

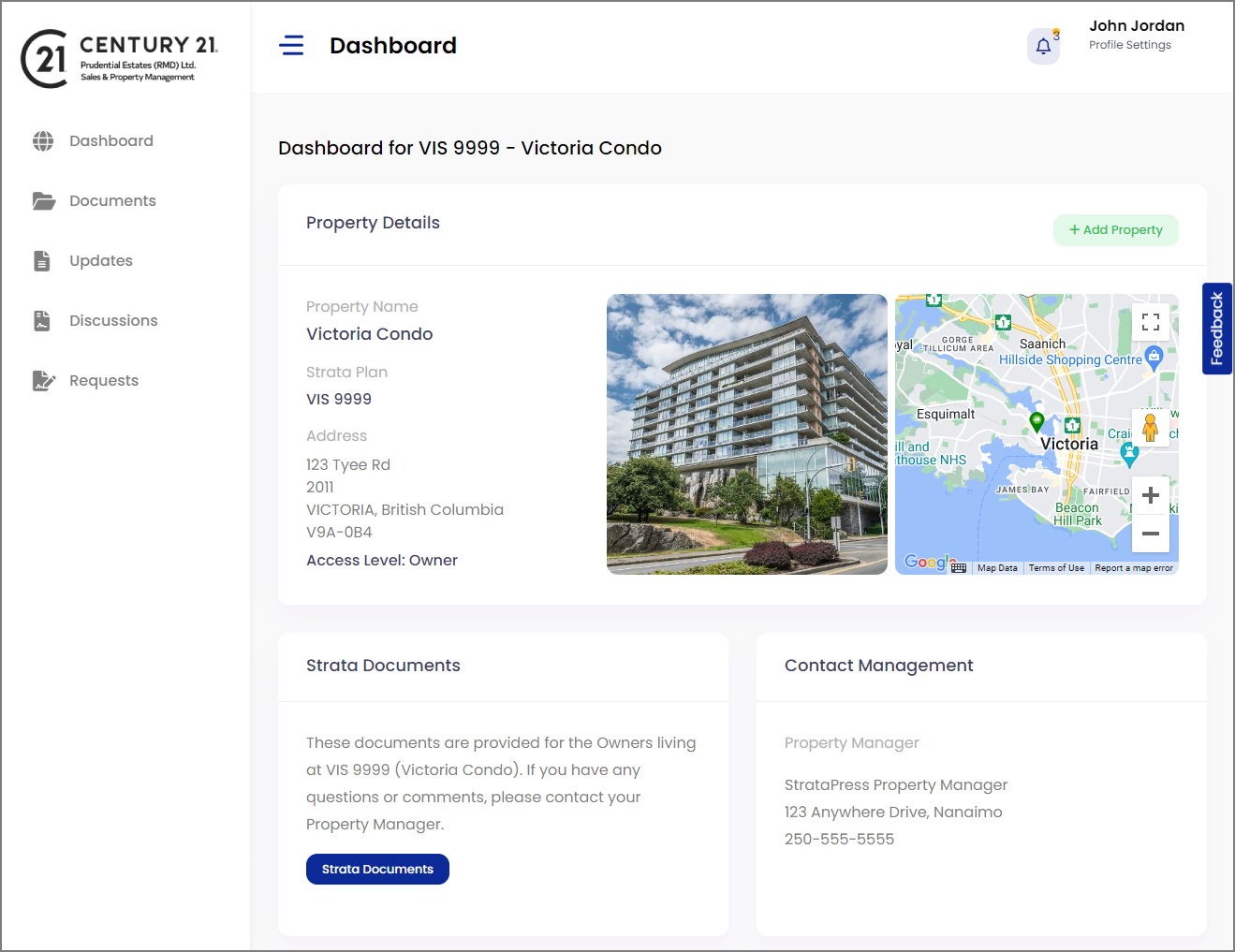

At CENTURY 21 Prudential Estates (RMD) Ltd., we believe proactive strata management can mitigate risks and prevent property damage. Our procedures and years of experience managing Strata Corporations sets us apart from our competitors. As part of our comprehensive strata management services, we will assist your Strata Corporation with frequent inspections by qualified and trusted trades, record keeping of incidents and building improvements, and routine property maintenance. While there is many things we can help your Strata with, insurers are starting to look at natural disaster assessment based on geographic location. Let our team help you navigate the complexities of strata insurance and request a free proposal today!

Note: While we have many years of experience helping Strata Corporations and condo owners with insurance information, we are not licensed for insurance services and always recommend speaking with a licensed insurance agent or broker.